The sales forecast is the most important number in any company in any industry. Decision makers rely on the forecast to determine how and when to fuel growth. When the team is hitting its number quarter after quarter, the company can invest and grow with confidence. That means more marketing campaigns to boost awareness, increased sales headcount to drive revenue and additional resources towards product development to not only sustain, but also boost that growth trajectory.

When the forecast isn’t accurate, it can lead to mistrust, indecisiveness and an inability to confidently invest in the future of the company.

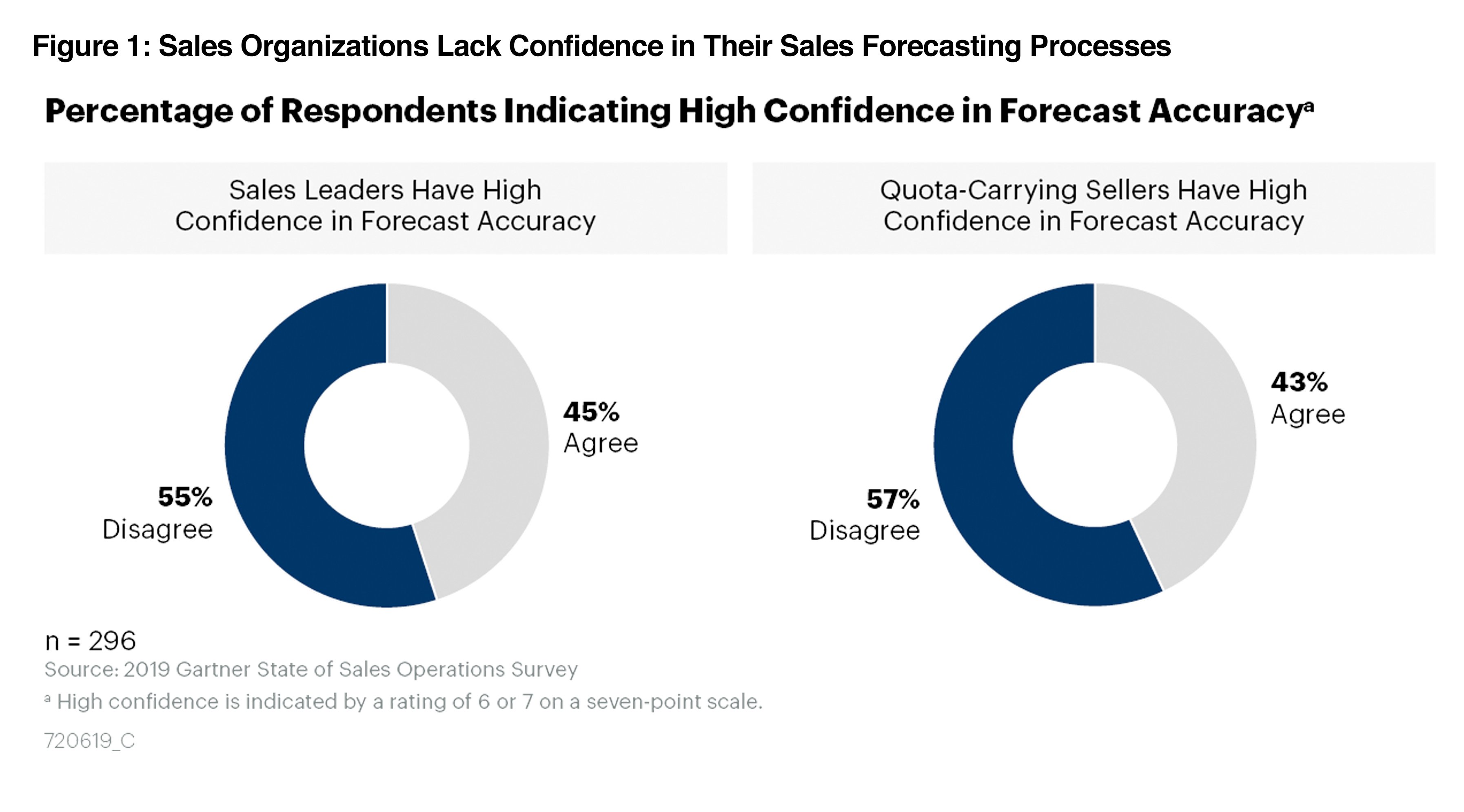

Here’s the problem: Achieving an accurate sales forecast is tough. In fact, we’ve found that 93 percent of sales leaders are unable to forecast revenue within 5 percent, even with two weeks left in the quarter. Why is that? What makes sales forecasting so difficult and what are the most common mistakes organizations make when trying to determine a forecast?

In this guide, we'll cover:

- The most common sales forecasting fails

- What a major sales forecasting fail looks like

- Roles and goals in driving sales forecasting accuracy

- How to forecast sales

- Sales forecasting metrics

- Sales forecasting methods

- Executing your sales forecasting processSales forecasting for startups

- Sales forecasting for mid-size businesses

- Sales forecasting for enterprise

The Most Common Sales Forecasting Fails

Organizations typically fall into the same trap when it comes to inaccurate sales forecasting and it involves people, process, and tools.

How do people contribute to common sales forecasting fails?

The sales forecast is not just a number. It’s one of the most important business processes in the entire company. When the forecast is accurate, you can invest and grow with confidence. When it’s not, company executives are forced to lead using guesswork.

If your team — the entire revenue operations team — is not bought into this belief, you’ll be fighting an uphill battle to hit your number. Creating a culture of sales forecast accuracy starts from the top, but must permeate through every front line manager and rep.

How do processes contribute to common sales forecasting fails?

Everyone in your sales team is different. And while we’re all for celebrating diversity, discrepancies in the sales process and the way reps forecast sales can be what makes or breaks your sales forecast.

Some of your sales reps are probably more senior and understand the industry, can see roadblocks on the horizon and, based on experience, have a pretty good idea when a deal is likely or unlikely to close. Others might be more junior and might not have the sales process honed or don’t understand buying signals quite as well. On top of that, you might also have some sales reps who don’t follow the sales cycle at all, over-commit and end up pushing several deals towards the end of the quarter.

When all of these cohorts are given free rein to forecast as they please, you end up with inconsistencies and inaccuracies. Formalizing your sales forecasting process and sales forecasting methods is critical to nailing your number.

How do tools contribute to common sales forecasting fails?

Whether you have a training problem (either sales or pipeline management training) or a process problem, having the right tools in place can help you identify issues early on or, in some cases, even identify potential solutions. Let’s go back to the hypothetical pushed deal we talked about earlier. You likely have a CRM in place and have a sales team adding data into it all the time (although, let’s be honest. Few actually do add data into CRM).

When you pull the numbers you need to calculate your forecast, it could be based on outdated data because of the nature of ever-evolving deals. The problem with your standard CRM is that it doesn’t necessarily tell you what’s throwing your forecast off.

Similarly, companies that use spreadsheets for forecasting are at risk of limiting themselves to stale data. Spreadsheets require manual updates and never quite provide a full picture into which deals have changed. Even if you export sales reports out of your CRM and plug them into a business intelligence tools or spreadsheets, you still run into the issue of data becoming outdated and this method is prone to human error.

Some companies have found that using an artificial intelligence or AI-based tool helps drive predictable revenue by automating sales activity data capture and sales forecasts so they are always up to date and in real time.

Your forecast could be off because your tools aren’t providing you enough support or accurate and complete data to properly manage and maintain your forecasts, inspect your pipeline and give you true visibility into the health of deals.

Organizations of all shapes and sizes often struggle with accurate sales forecasting.

Some other factors that create inaccurate sales forecasting and that organizations often struggle with include:

- Not having team buy-in on the importance of sales forecasting

- Lack of a documented sales process

- Reps not documenting deals in the CRM properly

- Not identifying out-quarter backfill

- Using outdated sales forecasting methods

- Being stuck in spreadsheets

- Not taking a data-driven approach to pipeline inspection

What does a major forecasting failure look like?

Missing your forecast might not seem like a big deal — hey, what’s a few bucks here or there, right? We’ll make it up in the next quarter. Or the one after that. Or... the one after that…? Hopefully?

Wrong. A missed forecast can be disastrous for the company — and every member of the entire revenue team needs to understand what that means.

Over-forecasting is when an organization under-delivers and the entire business can be in jeopardy. This could lead to devastating long-term consequences, such as negative impacts to valuation, poor stock performance or lay-offs.

Under-forecasting is when your sales team over-delivers on their quota. When an organization under-forecasts, the organization actually generates more revenue than anticipated and isn’t able to make decisions with enough lead time to think things through, especially around hiring, marketing or R&D. They miss out on opportunities to cast a wider net for growth, while their competitors move in.

Roles and Goals in Driving Sales Forecasting Accuracy

If you’re going to create a successful sales forecast, you need to have clear roles and goals for the entire revenue operations team. Each member of your sales, marketing, and leadership organizations greatly impact your ability to create and hit your sales forecast.

Account Executives’ role in the sales forecast. Your AEs seal the deal, of course! But your AE is crucial to setting the tone for your sales forecast. They must be able to accurately determine whether their opportunities will close or not — and report them as such for the sales forecast. One way to do this is with the 4-point deal inspection, a data-driven process that easily helps reps determine the health of any deal.

Sales Managers’ role in the sales forecast. The Sales manager’s role is to coach the AE throughout sales processes and pressure test their forecast to arrive at a realistic number for the quarter. If a sales manager spots risk in the pipeline, it’s their job to help the rep identify deals to pull in or an action plan to get the rep back on track. With the right processes, coaching and Revenue Operations solutions, it’s possible for sales managers to land within 2% of their week 1 forecast call.

Sales Leaderships’ role in the sales forecast. A culture of sales forecast accuracy starts from the top down. It’s important for sales leadership to verbalize the importance of sales forecasting accuracy and even tie compensation to it, if necessary. The most advanced sales leaders hold a variety of sales meetings (forecast call, pipeline call, QBRs, etc…) on a specific cadence to ensure regular inspection and execution.

Executives’ role in the sales forecast. Company executives should be heavily invested in the forecast because it determines the operating rhythm of the company. When the revenue team is hitting the number they’re calling, leadership can invest and grow with confidence. Executives should have full visibility into the forecast and be able to track progress throughout the quarter.

Marketing’s role in the sales forecast. If there is risk in the pipeline, marketing can support sales efforts by providing air coverage with campaigns to either re-engage stalled prospects or push them further down the funnel with targeted content. In addition, marketing should be looking out-quarter at pipeline and ensuring the revenue team has enough coverage to hit (and accurately predict) their number in future quarters.

SDRs’ role in the sales forecast. Your Sales Development Representatives are constantly at the front line of the sale. They’re the ones reaching out to prospects and getting them to take a demo with your organization. If SDRs aren’t empowered with the right list of prospects or the best tactics for reaching out, you could be setting yourself up for failure from the very start of your sales process. SDRs have the opportunity to create huge impact on pipeline, generating predictable revenue for quarters to come.

Now that you understand the different roles that are invested in the process of sales forecasting, it’s time to actually define your sales forecasting goals. Are you a startup and very focused on getting new logos to show market validation? Are you an enterprise with multiple product lines that you’re trying to grow? Wherever you are in your company journey, creating a sales forecast should start with clearly defined goals.

How to Forecast Sales: Start with Business Goals

Every sales forecast should start with the business goals of the company. These can include (but are not limited to): ARR, new logos, number of products sold and renewals.

Different companies at different stages might have different goals. Whatever target is most important to you is how you should anchor your forecast. For example, newer companies might prioritize landing more customers to get validation from the market, while growth companies may focus on revenue.

Here are 3 common goals we see:

Annual Recurring Revenue. For more SaaS companies with a subscription business model, ARR is the main metric of choice. ARR is basically how much revenue a company brings in each year and is an indicator of value to shareholders. Investors look to ARR as a key barometer in valuation. For growth companies, a skyrocketing ARR is a good sign of success.

New Logos. As we mentioned earlier, a company may decide to prioritize new logos for a variety of reasons. If the company is in its early stages and the goal is to show market validation or use those new logos to entice others to purchase, getting as many contracts signed as possible might be the end goal.

Number of Products Sold. Forecasting by number of products sold may be an option for companies with multiple product lines. This method of sales forecasting gives you more visibility into how each segment of the business is performing, giving you more insights into how to re-invest funds into R&D.

How to Forecast Sales: Identify Critical Sales Forecasting Metrics

Now that you’ve defined your business goals, you can consider the critical sales forecasting metrics you should be tracking to determine the health of your pipeline. Here are 9 of our favorite sales forecasting metrics we think every company should track.

Basic Sales Forecasting Metrics:

- Quota: As the old saying goes: You can’t hit a target you can’t see. You sales quota is your target and used as a guidepost to build your sales forecast around.

- Attainment: Attainment helps you measure the difference between where you are and where you need to be. Measuring attainment allows you to easily identify which reps may need help throughout the quarter.

- Pipeline Coverage: Pipeline coverage is the total sum of opportunities compared with your quota. If you need to hit $1 million and you have $3 million worth of opportunities you have 3x coverage. This tells you how much buffer you have to actually hit your number.

Next-Level Sales Forecasting Metrics:

Historical Conversions: Tracking historical conversions gives you a better understanding of what your team members are capable of in the future — and how much pipeline coverage you need to generate to hit your number.

Activity Data: Sales activity data, which includes any given activity performed by sales or marketing to close a prospect, is a critical barometer for the health of the deal. When sales activity data is readily available and easily visible, sales teams can easily see whether a prospect is engaged or not — and thus whether or not the deal is more or less likely to close.

CRM Score: Clari’s CRM Score helps revenue teams easily identify which opportunities may have a higher likelihood of closing based on machine learning and AI that analyzes historic wins and losses.

Advanced Sales Forecasting Metrics:

Sale Linearity: Sales linearity is when revenue teams close opportunities in a predictable pattern throughout the course of the quarter. Linearity gives your team a better chance of hitting your number by avoiding the last minute rush at the end of the quarter to sign contracts, get approvals and maneuver through logistical roadblocks.

Deal Slippage: Your slip rate is the percentage of opportunities that were in commit at some point, but then failed to close within their forecasted period. When you track slipped deals you can easily identify them and create action plans to close next quarter. Understanding your slip rates also provide you with some level of predictability to your sales forecast knowing some amount of your committed deals likely won’t actually close.

Next Quarter Pipeline: Some of the most advanced companies we’ve seen spend at least half of their quarter looking at out-quarter metrics to better predict where they will land — and how to prepare for it. Check out how Okta implemented this out-quarter cadence to drive predictable revenue in preparation for their impending IPO.

How to Forecast Sales: Choose Your Sales Forecasting Method

One of the challenges with sales forecasting is there’s not one right way. It all depends on what works for your business model. Here are 4 common types of forecasting methods to consider:

- Top-down sales forecasting: Start by identifying you total addressable market or TAM and and estimating how much market share you’ll be able to capture is created. This will require complex modeling, often by a team of analysts. Unfortunately top-down models don’t take into account actual opportunities in play and the models are limited by the fact that they’re just that: models.

- Bottom-up sales forecasting: Bottom-up sales forecasting starts at the ground level with reps reporting what they think they can close based on the opportunities in play. Instead of leadership developing models, bottom-up forecast requires managers and reps to inspect their pipeline, review sales activity and engagement and call their number.

- Qualitative sales forecasting: An estimate of sales performance is created based on long-time expertise or well-versed industry knowledge, rather than historic performance. Qualitative forecasting relies on industry knowledge from your experts in the field, rather than real data.

- Quantitative sales forecasting: Alternatively, quantitative sales forecasting relies on historic sales data to inform future sales predictions. Using a time-series sales forecasting model helps identify patterns in the data to predict where you’ll land based on current sales pipeline coverage.

We discuss all of the methods of sales forecasting in depth in our story The Definitive Guide to Sales Forecasting Methods (and Which Is Right for You).

How to Forecast Sales: Execute Your Sales Forecasting Process

Although every company may take a different approach to sales forecasting, we believe in the bottom-up approach because it’s based on data from deals happening in real time. Here’s how to forecast sales using a proven bottom-up process:

- Triangulate a Reality Check. Take inputs from historical data, what your team is telling you and what you’re being asked to deliver to pressure test your number.

- Inspect Your Pipeline. Ask about what changed in each deal, how likely each one is to close, deal activity, and identify deals not following the sales process. The 4-point deal inspection is handy here.

- Conduct Data-Driven One-on-Ones. Rather than asking your reps to go down the list and report everything that’s happening in their territory, come to your one-on-one sales meetings with a point of view backed by data. Spend your time strategizing instead of summarizing.

- Bring the Revenue Team Together. Break down silos and bring the entire team together to review the number and identify any risk in the pipeline. The forecast is not just the responsibility of sales, but marketing and customer success too.

Here’s how Clari VP of Sales Anthony Cessario uses this exact sales forecasting process to come within 2% of his week 1 number.

Sales Forecasting for Startups

Whether you’re just starting out or have a small team of sales reps, you might not have any type of sales forecasting at your organization. Why? Your sales team might be small enough to comfortably sit in a conference room, which means it’s not a huge burden to go through the sales forecast verbally. There might also be a lot of discussions about the status of deals, note-taking and some reliance on spreadsheets.

You’ve been too busy closing deals to focus on the future — we get it!

You might think it’s just not the right time to get overwhelmed with the various methods and tools that can hinder you in these initial stages.

Most startups tend to rely on solutions that are free and easy because forecasting your number verbally or in basic spreadsheets is manageable at this level. It may work for the time being, but as your team grows, so do the number of conversations you start having to nail down the number as well as the amount of time spent doing this tedious process. To get ahead of that breaking point, startups should seriously consider moving up in their sales forecast maturity when the time is right.

Forecasting your number based on the sales reports of sales reps and managers means a reliance on the rep’s intuition, not hard data. And at a company of this size, one bad miss could be catastrophic. Consider a Revenue Operations solution that adds deeper revenue insights based on machine learning and AI so your team can easily identify the deals that need the most attention.

Sales Forecasting for Mid-Size Businesses

Whether you’re a startup that has scaled or an older organization looking to revamp your forecasting, this section is designed just for you.

It’s likely that you’re currently using either spreadsheets, your CRM, or a combination of the two to create your sales forecasts. CRM is an essential system of record, but it’s not enough.

Reps just don’t have time (nor do they want) to manually enter data into the CRM. This means not only is the CRM not accurate and up to date, but any type of machine learning function is now working off an incomplete set of data points.

In addition, if you’re using spreadsheets, you’re likely spending your Sunday evenings rolling up the forecast manually. And here’s the thing: No matter how detail-oriented you might be, spreadsheets are still prone to error and disconnected from real-time opportunities.

Find a Revenue Operations solution that not only automatically captures sales activity data so your reps don’t have to manually input it into the system, but also automates the forecast. In addition, because a Revenue Operations solution automatically captures sales activity data, it can now apply AI and machine learning to that full and complete data set for better insights.

Sales Forecasting for Enterprises

You have a team of dozens, if not hundreds, of sales reps around the world. You’ve got multiple product lines and teams solely focused on the various types and sizes of organizations. Sales has become a complicated beast, but don’t worry, you can tame it!

We’ve seen enterprises use everything from spreadsheets, their CRM, or a combination of spreadsheets, CRM and business intelligence tools to try and cover all of their basis. Unfortunately, this still doesn’t cut it.

The bottom line is salespeople just don’t update the CRM, leaving sales leaders in the dark without actionable data. This leads to management by intuition and an inability to get a sense of pipeline quality leading to a lack of confidence in the forecast.

Revenue Operations solutions can help with this by making your revenue process more connected, efficient and predictable.

Why Sales Forecasting is Critical to Success

“Success is a journey, not a destination. The doing is often more important than the outcome." - Arthur Ashe

Sales forecasting, in many ways, tells you where you can go, but it’s the action in between that truly helps differentiate your business from all others. Staying true to your vision, to your value proposition by setting realistic goals based on an accurate sales forecast requires discipline along the way. You can’t grow if you don’t know where or how much to invest and sales forecasting helps get you there.

Regardless of what the process might look like for you, accurate sales forecasts create:

- Alignment between sales and marketing

- Trust between the entire organization

- Opportunities to reinvest revenue

- Shareholder confidence

- New technology investment opportunities

For more stories on sales forecasting, read below:

- The Importance of Sales Forecasting from Clari CRO Kevin Knieriem

- 9 Tips for Building a Culture of Forecast Accuracy

- The Evolution of the Sales Forecast (Infographic)

- 9 Critical Sales Forecasting Metrics

- Best Practices for Improving Sales Forecasting Accuracy

- How to Nail Your Forecast Within 2% of Your Week 1 Number