Let’s take your pulse on these two words: sales forecasting.

If your physical reaction is less than pleasant, you’re not alone. According to Gartner’s 2020 state of sales operations, less than half (45%) of sales leaders have confidence in their forecasting accuracy. This skepticism results in sales leaders acting on intuition instead of data, which leads them to miss out on critical revenue gains.

Many of these organizations use spreadsheets. But if you want to grow in today’s unforgiving landscape, that isn’t going to cut it. It may seem like the least expensive solution with your sales ops Excel masters at the helm, but there’s a high cost to spreadsheets that hits every part of the business.

The truth is the sales forecast isn’t just a wayward spot on the map. It’s the destination to which your entire organization sets its sails.

The same Gartner study found that 57% of sales operations functions support marketing, 38% support product, and 35% support finance departments. The takeaway: When operations leaders spend hours each week sifting through spreadsheets, the whole organization loses out on valuable opportunities.

Here are four ways you may not realize your spreadsheets are costing you.

Spreadsheets are static snapshots of a moving target

Using a spreadsheet to hit your sales forecast is like taking a mental picture of a piñata, putting on your blindfold, and expecting to hit it. Pipelines are moving targets, if you want to ensure you hit yours, you need real-time visibility.

Spreadsheets are a snapshot in time when your teams need real-time actionable insights in order to hit their revenue goals. Sales reports take hours to roll up and are often left sitting in an inbox for days. Meanwhile, the pipeline is developing in real-time, making that report out-of-date. The minute you pull deal data into a spreadsheet it becomes disconnected from what’s actually happening in the real world, introducing unintended inaccuracies into your critical decision making process.

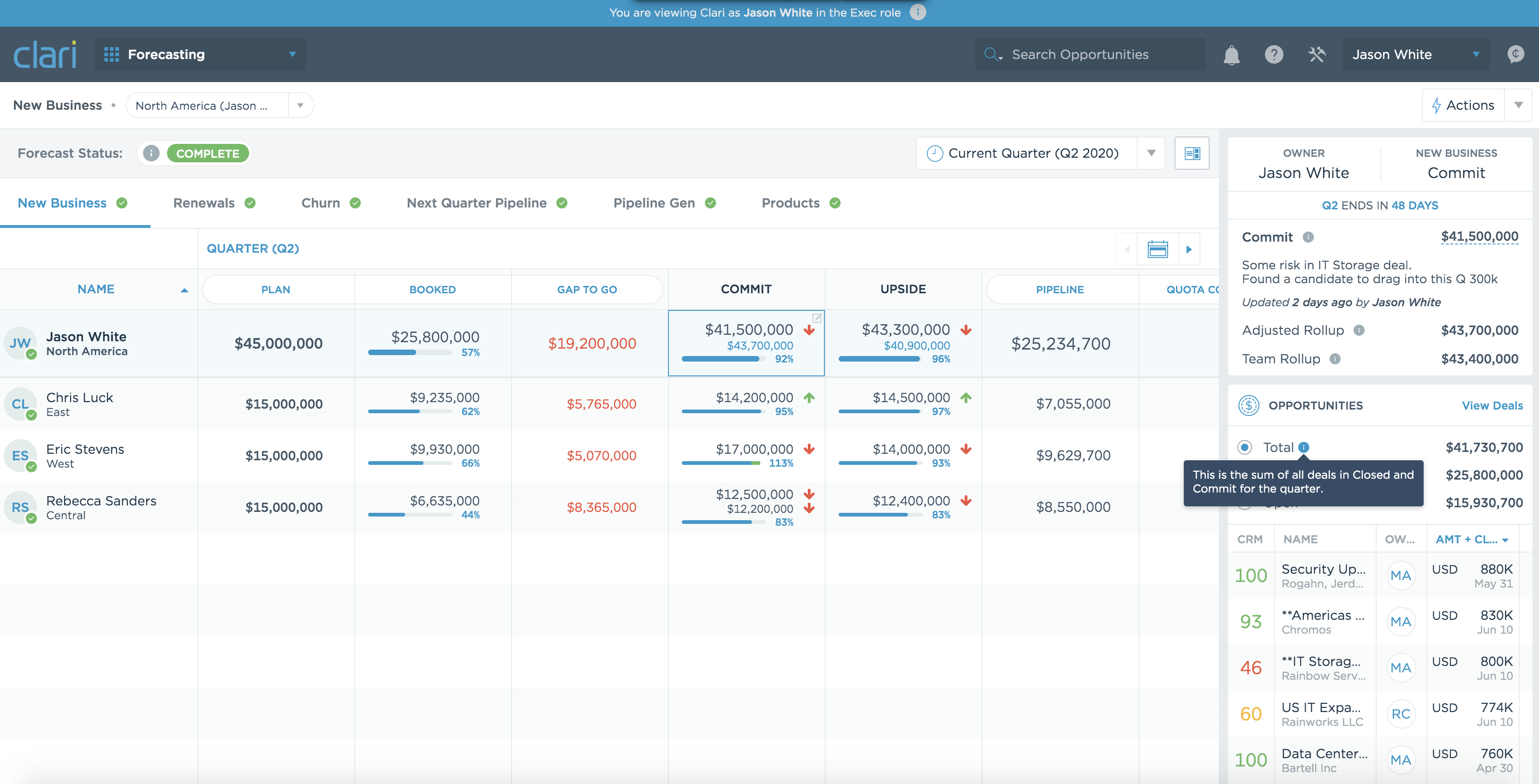

Sales teams need real-time indicators showing what has changed in order to focus on the right deals and take the right actions. They need a tool that has a bi-directional connection between their sales data sources and sales reports that make it easy to see actionable information like:

- Opportunity risk assessment: the ability to inspect deal risk based on CRM activity as well as rep email and calendar activity.

- Activity scoring: the ability to score opportunities based on the level of sales activity, so that high or low engagement levels are easier to spot.

- Pipeline progress inspection: the ability to see how the pipeline is evolving throughout the quarter so marketing and sales can know where more pipeline build is needed.

- Real-time update indicators: the ability to show historical changes to opportunity fields in real-time and highlight deals with no recent updates.

- Quarter-over-quarter status: the ability to compare the status of the current quarter with the same time in previous quarters so teams can see how the business is trending over time.

The cost: Outdated information leads teams to take the wrong actions for their pipelines.

Too much flexibility keeps the entire revenue organization from leveraging a unified forecast

Your North America Sales team loves their spreadsheet, why should you ruin a good thing?

What if Finance wants to see the global forecast? Or, your new CRO wants EMEA to have the same reporting format as North America? Or, your product team built a second product and now you need to reconfigure your entire spreadsheet and retrain them how to use it? And exactly how do you shift the spreadsheet when you get a new rep or have to change territories? What happens when Marketing needs to know which accounts to support with a campaign?

You catch the drift.

The entire go-to-market team needs access to personalized insights about the pipeline, deals, and sales forecast. Without access to this data, you see wasteful back and forth and wrong conclusions.

The flexibility of a spreadsheet limits how much data can be used for accurate sales forecasts because everything has to be manually maintained and updated. As your organization grows, imagine trying to corral data from hundreds or thousands of reps into a single spreadsheet. You need a tool that promotes standardization or democratizing processes that you want your entire team to adhere to.

While one team may love their complex spreadsheet, it’s static and doesn’t help inform the entire revenue organization. Spreadsheets require heavy lifting from sales operations to validate, standardize, and consolidate the myriad sales reports into a single document. Businesses need flexibility to grow and change, their forecasting tool needs to reflect that.

The cost: The inflexibility of your spreadsheet makes it hard to recreate success, pivot, grow, or provide visibility the revenue organization needs to make business decisions.

Everyone is using different terms that make words like “commit” meaningless

Are you building a world class organization or The Tower of Babel? In a spreadsheet it’s impossible to ensure everyone is speaking the same language at scale. What does it mean to put a deal in “commit”? For one rep it could mean they have a good gut feeling about it, while another might wait until they have a signed contract in hand to take the leap.

How can your sales forecast be accurate if the team isn’t clearly aligned on terminology? Are operations leaders and analysts across the organization even aligned? Or is there a different set of definitions within each territory?

The cost is twofold. First, the price of an inaccurate forecast. The second is time wasted trying to teach everyone how to use the same terminology over and over again. You need a tool that can easily track global pipelines and set clear guidelines on what each stage means right within the tool itself, ensuring compliance and uniformity.

Imagine the time reduction in sales enablement when you have a tool to deploy as opposed to a spreadsheet.

The cost: A lack of clear, aligned terminology renders sales forecasting or accurate predictions useless.

The high price of manual number crunching, analytics, and human error

Spreadsheets were built for operations, not for revenue teams. These disconnected and disjointed sales reports require customization, analysis and a heavy lift from operations. When you have a spreadsheet you have to carve out somebody's time.

You have to hire analysts to follow up with reps and sales leaders, bugging them to update sales forecasts. They’ll need to spend 4-12+ hours crunching numbers. And if you don't have a standardized process, you're compounding the problem where marketing, finance, or your international teams are following different guidelines.

The cost of a spreadsheet quite literally = The salary of analysts' time

+ amount of time explaining how to use the spreadsheet (multiplied per end user)

+ number of hours trying to figure out what happened to that one deal that was in the forecast last week and no longer there because it had slipped.

Even with all of that investment, revenue leaders are still left to make decisions based on outdated data. And when is the last time you had a 1000+ seller organization give what you need in a single spreadsheet? Never.

Relying on spreadsheets is time consuming and prone to human error. Even the smallest mistake can throw everything off. People will inevitably make a copy of the spreadsheet to adjust it for their needs. Before you know it you have multiple versions, mistyped formulas, accidental deletions — and those are just a few of the missteps that can throw a sales forecast into disarray. This requires painful heavy lifting by the back office to adjust all the spreadsheets in order to roll up the forecast into one cohesive and congruent document.

The cost: Time is money. Spending hours crunching numbers instead of creating actionable sales strategies for your pipeline is money wasted.

Scale beyond spreadsheets, conquer the path to revenue confidence

Clari is the key to unlocking revenue confidence. Learn how you can save time and see your sales forecast in real time, flexible, scaleable, unified, and free of human error. Check out our pathway to revenue confidence.