The last thing you want is for your sales reps to sink hours into prospects who don’t need or can’t afford your product. The more time they spend on viable leads, the more deals they close. It’s that simple. But qualifying prospects isn’t an easy process.

A sales qualifying framework like MEDDIC can help. It lays out how your reps should interact with prospects to qualify them through different stages of the sales journey.

This article breaks down what MEDDIC is, why you need the framework, common misconceptions, and how to get started.

Table of contents:

- What is MEDDIC?

- Why your sales team should use MEDDIC

- Common misconceptions about MEDDIC

- How do you start implementing MEDDIC?

- What’s next?

What is MEDDIC?

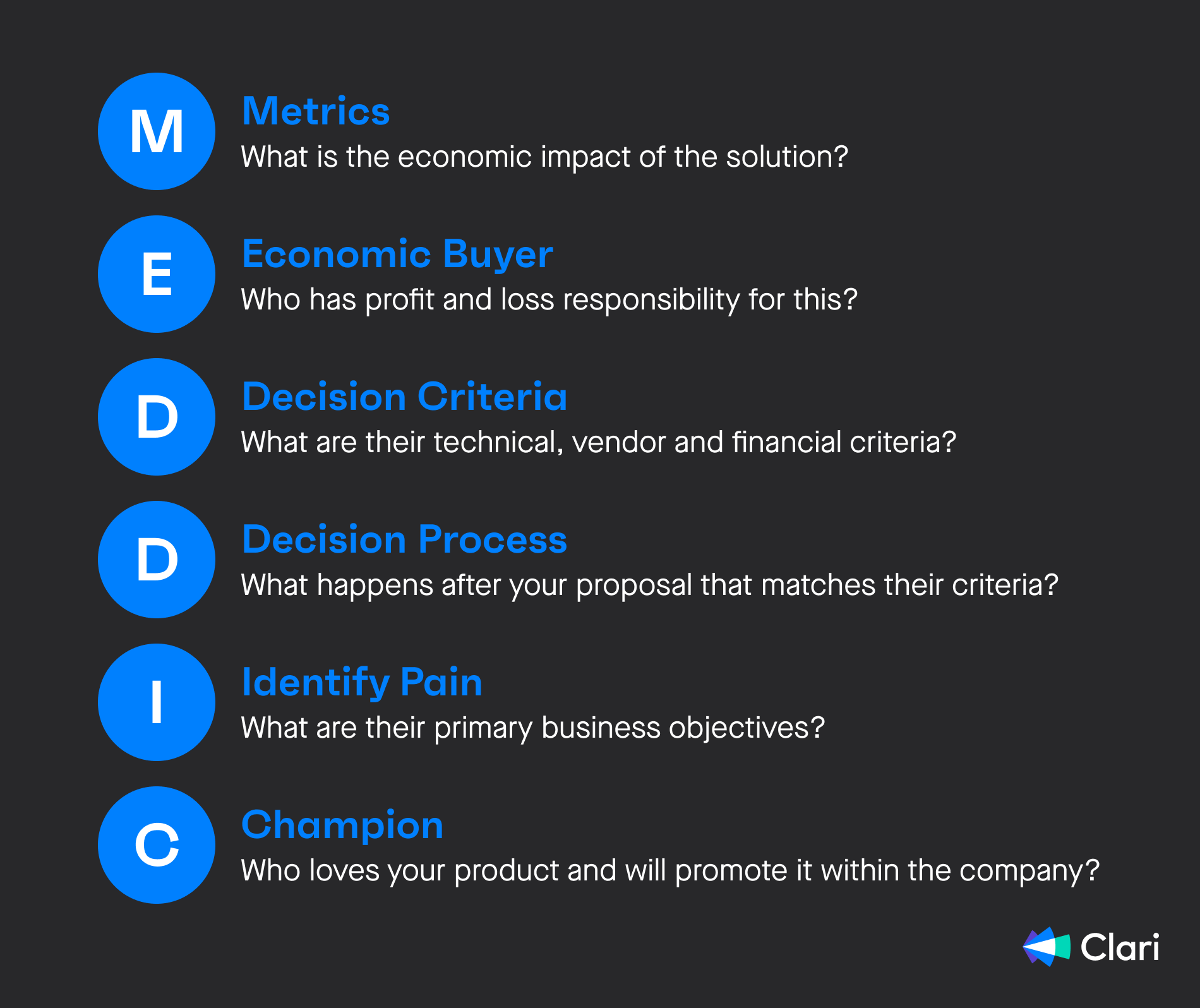

MEDDIC is a sales qualification framework your sales team can use to prioritize prospects to work on closing. The MEDDIC acronym stands for metrics, economic buyer, decision criteria, decision process, identify pain, and champion.

Each represents an aspect of sales opportunities that sales reps need to understand to qualify each deal.

The sales team at Parametric Technology Corp (PTC) originally developed MEDDIC in the 1990s. It helped them grow for 40 straight quarters, growing from $300 million in sales to $1 billion and beyond. Over the years, the framework has been proven to suit complex sales cycles that often involve the following:

- Multiple buyers or a buying committee

- A sales champion that will help the deal through internal hurdles

- Average sales cycles lasting more than four months

- Contracts that require big budgets

- Situations where a product will require some level of change management

Metrics

Metrics in MEDDIC is about getting a true image of how your product can change your client’s company. You want the prospect to quantify how your product will impact the company.

Here’s how you do that:

Work with your customer to figure out the economic impact your solution will have on the customer’s organization. What will the customer gain?

It should be quantifiable. In other words—show, don’t tell. For example, rather than saying, “Our solution will help you see more traffic,” quantify that for the customer: Does that mean 20,000 more visitors per day? 100,000?

Offer specific numbers for each benefit you’re touting. For example: “Our customers save 12 hours per week on data entry,” or, “A client of ours in your industry saw an ROI with our product within three months.”

Economic buyer

The economic buyer stage is where you figure out where you figure out who has the final say on a purchase decision. It doesn’t matter if an average employee loves your product. You need the sign-off of a manager or executive who controls the budget. That’s why this is a crucial stage in the sales qualification process.

Sales reps should ask themselves: Am I speaking to the person who actually has the authority to make the purchase?

In other words, they hold the keys to the checkbook. If you’re not speaking with this person, make sure you gain an introduction. And if you get an intro, you must win this person over. You’ll want to know what they’re looking for in a solution and what their pain points are.

Decision criteria

You also need to understand how your potential customer judges the viability of products in your category. What are their requirements for making a purchasing decision?

To dive into this, you can ask questions like:

- What are their decision criteria for purchasing solutions?

- What made them purchase (or pass on) similar products in the past?

Criteria will vary by company, but typically, they are assessing how much they trust the vendor, how important the problem is for them, what the change management effort will be, and how this affects the decision maker personally (especially if it doesn’t go well).

Decision process

And it’s not just the who or the why. For your sales activities to be effective, you need to know how the organization makes buying decisions.

In other words, you’ll need to be well-versed in the process that your prospective client engages in when they make a purchasing decision. This includes understanding who the stakeholders are, their operational timeline, and any approvals needed. When you know what the decision process is, you’re more likely to be able to move the deal forward and less likely to stagnate or lose it.

This is a crucial part of forecasting a deal’s likelihood of closing. Get our in-depth guide on 12 sales forecasting methods that work for more tips.

Identify pain

If you know your customer’s pain points, you can help them see how your product makes their lives easier.

Talk to your customers; find out whether it’s slow production, decreasing revenue, attrition, or poor customer service that’s keeping them up at night. Highlight ways your product directly solves the pain points they are experiencing.

Champion

A crucial part of the enterprise sales process is finding someone who loves your product. You need a champion, an evangelist, to help you convince less-involved managers.

Here’s how you find them:

- They work in the role of directly using your product.

- They are the person most likely to see the value in your product.

- They are impacted most by the pain points and would personally benefit from your solution.

- They may even have signed up for a demo on their own initiative. (“Early adopters” often make the best champions.)

Regardless of whether this person is the main stakeholder, the champion should be well-respected and have good communication with leadership.

Why your sales team should use MEDDIC

Why do you need a qualification methodology? Pursuing deals that have very little to no hope of closing is a waste of precious time and resources. Qualifying your deals early allows you to focus your efforts on the best prospects.

To understand why your sales team needs MEDDIC, who better to ask than its source? John McMahon was integral in developing the popular enterprise sales methodology at PTC.

In his best-selling sales book, The Qualified Sales Leader, he lays out the case perfectly:

“Found business pain creates opportunity. Quantified business pain drives higher price points. Implicated business pain drives urgency. Business pain and urgency finds business Champions. Business champions get you to the Economic Buyer. The Economic Buyer has access to major funds. You sell big deals based on value.

The opposite is also true: No discovered pain means a small or no opportunity. No quantified business pain means no cost justification. No implicated business pain means no urgency to buy. No business Champion means no access to the Economic Buyer. No access to the Economic Buyer means no access to major funds. No access to major funds means either selling small deals based on product features or selling no deals.”― John McMahon, The Qualified Sales Leader: Proven Lessons from a Five-Time CRO

Enterprise sales teams will struggle to close big deals without a single letter in the MEDDIC acronym. They'll get stuck without being able to turn prospects into customers.

MEDDIC is a systemized qualification approach that doesn’t just help you weed out bad prospects. It also helps you build a relationship with prospective clients.

Closing becomes easy if your sales reps truly understand their pain points, buying criteria, process, and metrics.

In 2022, 53% of B2B buyers said a vendor understanding their needs was a top-five factor when making purchase decisions. Fifty-four percent highlighted features/functionality, and 50% indicated deployment time and ease of use.

That means your reps’ knowledge of their prospects’ situation is vital to closing deals.

If you create a sales playbook that matches MEDDIC principles, your sales reps will be halfway there.

Common misconceptions about MEDDIC

Some sales leaders consider MEDDIC a universal band-aid for their entire sales process. This isn’t the case.

Below, we dispel this and other common misconceptions about MEDDIC:

1. MEDDIC is a sales methodology

MEDDIC is often grouped together with Solution Selling, SPIN Selling, the Challenger Sale, and Sandler Sales. These are great methodologies that provide guidance for what to say in specific situations to move the sale forward.

But MEDDIC is NOT a sales methodology. It’s a sales qualification methodology. It doesn’t provide you with a playbook for how to move the sale forward. It provides you with a set of criteria to disqualify prospects who aren’t ready to buy.

2. MEDDIC can be used to qualify every prospect

The term “qualification” needs some defining as well. Many sales representatives believe you can apply a specific sales methodology to prospects so they become qualified to buy.

But that’s not qualification. Sales qualification is an active process of deciding whether a prospect meets the criteria needed to make a buying decision. In many cases, prospects aren’t actually ready to buy. Or they have internal issues that might prevent them from closing the deal.

Not every prospect is qualified to take up your reps’ time. And no amount of persuasion or nurturing will make them qualified.

That’s where MEDDIC comes in. It helps you quickly disqualify prospects who aren’t a good fit now.

3. MEDDIC is a checklist of questions to ask your prospects

This is an interesting one. MEDDIC looks and feels like a checklist. But it shouldn’t be treated as a checklist when you’re engaging with a prospect.

Newer sales reps often don’t understand this. They treat MEDDIC like a questionnaire, running through the questions as if they’re grilling the prospect. This can rub the prospect the wrong way and could even drive off qualified prospects. It’s not ideal for progressing through the customer journey.

If your team is turning off their prospects, make time to evaluate how they’re using MEDDIC. Coach them on ways to work the questions into natural conversations. This takes practice and comes with experience. Seasoned reps can make this look seamless.

4. MEDDIC takes too much time to implement

Many sales representatives are type-A, can-do, get-it-done personalities. They would rather be in the arena than in the stands.

These are great attributes if you want your people to pick up the phone, make calls, and move prospects through the pipeline. But these same attributes can make reps distrust MEDDIC, believing it will slow them down.

In reality, MEDDIC doesn’t take time away from selling. It saves reps from pursuing prospects that can’t or won’t pull the trigger. If your reps resist MEDDIC for this reason, explain that it’s a time-saver, not a time-waster. Then, provide sales coaching on ways to find answers quickly and effectively without treating it like a questionnaire.

5. MEDDIC disqualifies everyone

Another complaint from reps is that MEDDIC disqualifies too many prospects. Salespeople want to spend time selling, which often gets confused with convincing. But you can’t convince an unqualified prospect.

And if you disqualify too many prospects, you have to go back to prospecting, which may feel like a step backward.

There’s a lot to address with this objection. To begin with, MEDDIC doesn’t disqualify everyone. It shines a spotlight on the prospects who are most likely to close. So, reps can manage their time more effectively, working only with qualified prospects who are a good fit.

And if your reps are concerned that they’re disqualifying too many prospects, the problem may be your prospecting, not MEDDIC. Focus on building a better pipeline. You need to attract qualified prospects instead of nurturing unqualified prospects.

6. You’ll burn your bridges

New sales reps are often uncomfortable saying “no” to a prospect. They fear that turning away a disqualified lead could burn their bridges with them—especially if they might be more qualified in the future.

But disqualifying a lead early is a win-win, and your prospects will understand that. By being honest with the prospect, the rep can actually build trust and deepen relationships with them, which leaves the door open for re-engaging them down the road.

Coach your reps on how to break it off with a prospect. Let them know there’s no need to abruptly announce, “Sorry, I can’t spend more time with you. You’re not qualified.”

Instead, coach them to say something like, “I’m not sure if this is the right time for you. Let’s circle back around in a few months.”

It’s all in the delivery.

7. It can’t be a true methodology if everybody’s adding letters

It’s true that MEDDIC does have variations, including MEDDICC and MEDDPICC.

Some critics feel that adding additional letters distorts the original framework. If it needs “fixing,” does it actually work?

But this objection comes from an inflexible, fixed mindset. Organizations have different needs and reasons for adopting one flavor or another of MEDDIC.

For example, if a product involves a complex set of approval steps, the sales team might want to add the P, “Paper Process.”

It’s important to remember that every sales organization and its products or services are different. They can’t be shoe-horned into a static qualification methodology.

MEDDIC is a flexible framework made to help you focus more of your time on your ideal customers. By making a few simple adjustments, you can make MEDDIC work for your unique needs.

How do you start implementing MEDDIC?

Implementing the MEDDIC methodology throughout your sales organization can streamline your sales process and take your revenue operations to the next level.

But implementing it in the right way is easier said than done. To get started in the right direction, follow these four steps:

- Lay the foundation for MEDDIC with solid sales enablement

- Build MEDDIC into your deal inspection process

- Bake MEDDIC into your CRM, RevOps platform, and Mutual Action Plan templates

- Encourage a culture of proactive disqualification

1. Lay the foundation for MEDDIC with solid sales enablement

Make sure your sales enablement team makes it easy for reps to qualify without having to ask too many repetitive questions.

How do you do that? Empower your sales reps with intent data and important firmographic (and other) metrics about each prospect.

82% of top-performing sales reps always research prospects before booking calls or doing outreach.

A good sales enablement program does that research for them. Help your best reps avoid spending time on poor leads from before stage one. That gives them more time to focus on closing deals and helps them realize their true sales potential.

Even the best sales pitch will fall flat if there’s no inherent need or budget.

2. Build MEDDIC into your deal inspection process

MEDDIC is an excellent way to organize deal inspections. It can even act as the agenda for one-on-one meetings. Front-line sales managers should build the habit of referring to MEDDIC during this process so reps learn to come prepared to speak to each criterion. It will help them communicate a more consistent, comprehensive understanding of deal health.

Using MEDDIC to optimize the deal inspection process also makes reps feel more prepared and confident going into deal inspections and gives them more time with their manager to discuss ways to save deals in danger and identify potential roadblocks.

Remember, qualification is an ongoing process. It doesn’t end after the first discovery call. It could be useful to update and refer to the MEDDIC framework when continuing to inspect the health of an open deal over time.

3. Bake MEDDIC into your CRM, RevOps platform, and Mutual Action Plan templates

Many organizations use MEDDIC status as exit criteria for CRM opportunity stages. For example, a deal can’t progress from discovery to validation unless you’ve identified the economic decision maker and had at least one meeting around success metrics for that specific buyer.

Knowing the deal can’t advance to the next stage without meeting MEDDIC criteria motivates reps to capture that data early. It also stops reps from advancing deals before they’re properly qualified, which will save a ton of resources spent on companies that aren’t really ready.

Your RevOps platform should have a view of each opportunity’s MEDDIC, to stop deals that have incomplete data from moving forward or being included in the forecast. If you already run deal inspections out of your RevOps platform, then it’s natural to include MEDDIC in your dashboards so reps and sales managers can quickly see where there may be gaps in MEDDIC.

While MEDDIC is a useful framework to use internally to qualify opportunities, you don’t want reps running through the criteria directly with customers. It’s best to bake these criteria into major milestones of a Mutual Action Plan. That way, you can be confident your reps are gathering MEDDIC qualification criteria in a customer-friendly way. If your Mutual Action Plan is integrated into your RevOps platform or CRM, then you’ll be able to automate the capture of MEDDIC criteria to save time.

4. Encourage a culture of proactive disqualification

MEDDIC is a qualification framework, but sometimes, it’s useful to think of it as a disqualification framework instead. Disqualifying a deal early should be celebrated. The rep didn’t lose the deal if there was no deal there in the first place. MEDDIC simply helps identify those bad, time-consuming opportunities early and frees up reps to focus on closing good deals faster.

It can be hard for reps to disqualify deals that show even the smallest hint of life, which is why MEDDIC is a useful framework to reference when making hard decisions. There is a balance, of course. Reps shouldn’t disqualify deals because they are not 100% perfect. But if a deal is on edge, this is a perfect time for reps and managers to use the MEDDIC rubric to steer the conversation during the deal inspection and make the final call.

But don’t take things too far; you don’t want to waste potential deals based on assumptions. Start by establishing a need (you should already have pre-qualified the economic potential). Don’t let everything else clog up the first stage of your sales pipeline.

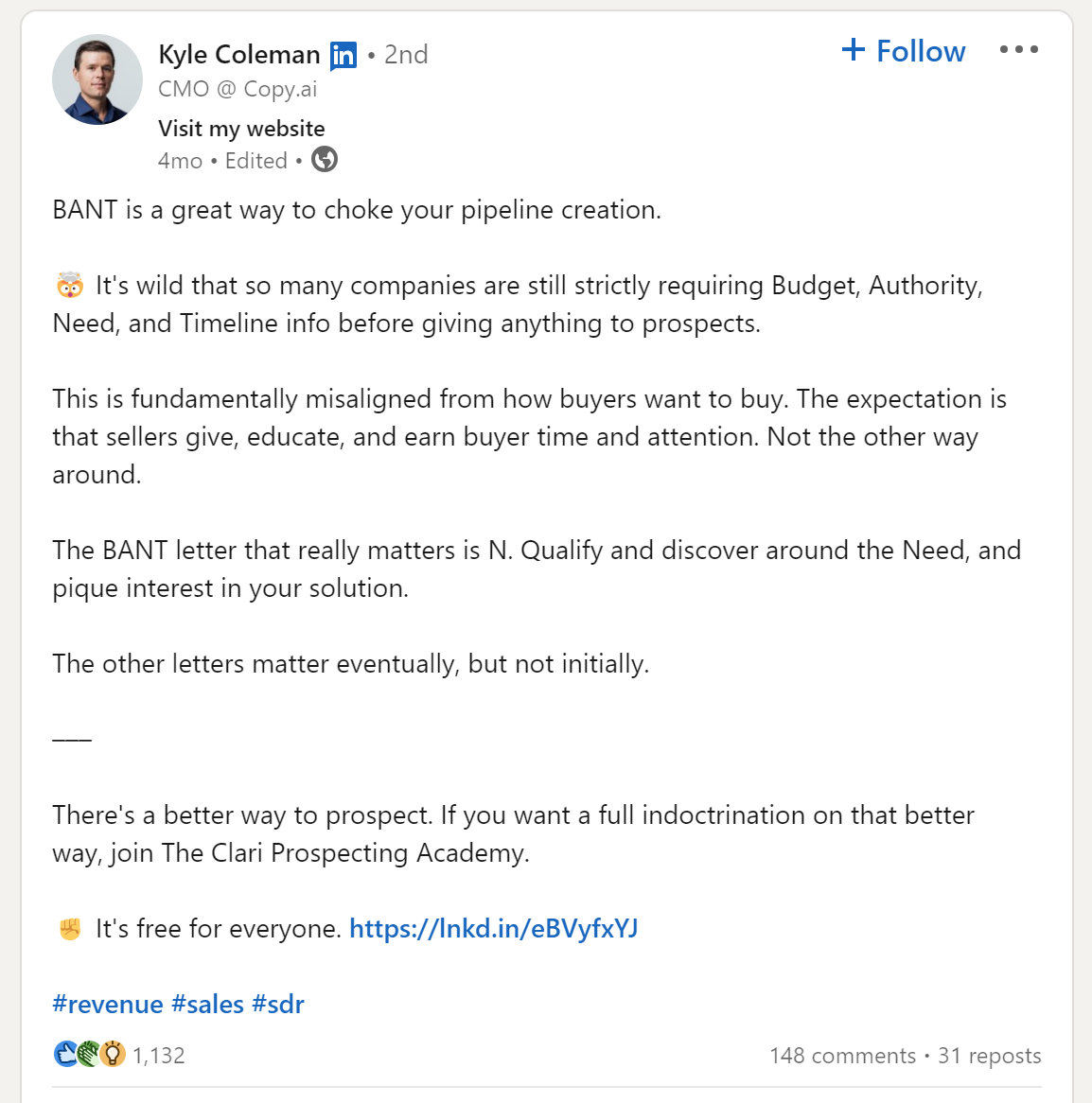

MEDDIC, when applied in the wrong way, shares issues with BANT, where reps can start interrogating prospects instead of delivering value:

Your sales professionals need to earn time and attention from busy executives. So their focus should be educating them, giving value, and understanding their needs.

If you already know from prospect research that the budget and need are likely there, focus on the sales process, not too much on qualification.

What’s next?

MEDDIC is a solid way to increase the ROI of your sales activities and speed up your sales velocity. But how do you ensure that your reps implement these ideals and focus on high-value deals daily?

One option is to recreate playbooks and retrain sales reps across your organization. There’s a shortcut, however. You can let AI help your reps prioritize the highest value (and highest likelihood) deals.

Clari offers multiple tools for this, like smart lead scoring and our deal prioritization matrix:

And this is only scratching the surface of how Clari can help your sales team.

- Our revenue intelligence platform helps you adjust your sales strategy over time.

- Improve prospect alignment with mutual action planning tools.

- Boost the performance of each rep and create better training programs with conversational analytics.

Sign up for a demo today to see Clari in action.