For revenue operations at a software-as-a-service (SaaS) company, one of the most important metrics to track is revenue churn rate.

Unlike customer churn, which focuses on the percentage of customers lost each month, revenue churn expresses the percentage of revenue lost each month. The difference offers insight into the stickiness of your products or services, whether customers are upgrading or downgrading their subscriptions, and how all of that impacts your bottom line.

Understanding revenue churn is vital for recurring revenue businesses because it gives you an accurate measurement of revenue growth. Without it, leaders may not understand why customers are churning and how that churn impacts profits. With it, you can find ways to improve customer retention and plan your next phase of growth more accurately.

What is Revenue Churn?

Revenue churn describes the revenue lost from canceled and downgraded subscriptions during a given period of time.

Revenue churn measures the financial impact of upgrades, downgrades, and cancellations from your current customers. Revenue churn differs from customer churn, as it measures more than whether your customers have paid or not. While customer churn remains a key metric that represents the overall health of a SaaS business, revenue churn speaks to profits, forecasting, and growth.

Calculating Revenue Churn

Ideally, revenue churn should be measured monthly. But you can perform a revenue churn calculation for any period: monthly, quarterly, or annually. To get started, you need three numbers:

- Recurring revenue at the start of the period

- Recurring revenue lost during that period

- Recurring revenue from upgrades

You’ll then use this formula:

Revenue Churn = [(RR lost - RR from upgrades in that period) / RR at the start of the period] x 100

You must only calculate lost recurring revenue to calculate revenue churn accurately. Depending on how a firm tabulates its contracts, some customer upgrades may appear as a canceled contract (customer churn) when in reality, they’ve signed anew at a higher rate.

A negative revenue churn rate indicates that you’ve gained revenue over the month. While it’s acceptable to have a low churn rate, say 10%, the goal is to achieve zero revenue churn. A negative churn rate is even better.

Let’s look at an example. In this scenario, the starting monthly recurring revenue (MRR) on January 1 was $100,000, but the month ended at $104,500 revenue.

Divide that number by the Starting MRR: 4,500 / 100,000 = .045. Multiply by 100 to create a percentage.

Revenue Churn = [(Lost Revenue - Upgrade Revenue) / Starting Revenue] x 100

= [(7,000 - 2,500) / 100,000] x 100

= (4,500 / 100,000) x 100

= .045 x 100

= 4.5%

Revenue churn calculation for multiple plans

You can use the same formula if you have multiple plans or tiers of membership. Simply segment your customers and calculate the total figures.

For example, let’s say that at the beginning of the month, you have:

- Basic Plan: 1,000 users at $500/month = $500,000

- Premium Plan: 250 users at $1,300/month = $325,000

Your starting MRR is $825,000 ($500,000 + $325,000).

Use this same approach to combine your numbers from every plan before plugging them into the formula.

Customer churn calculation

As mentioned above, customer churn is different from revenue churn. But it’s an important metric that can help you know how to improve your revenue churn.

Customer churn is calculated as:

Churn rate = number of churned customers / total number of customers

Tips for Reducing Revenue Churn Rate

How do you improve your churn rate? Let’s look at some common ways to evaluate and reduce churn.

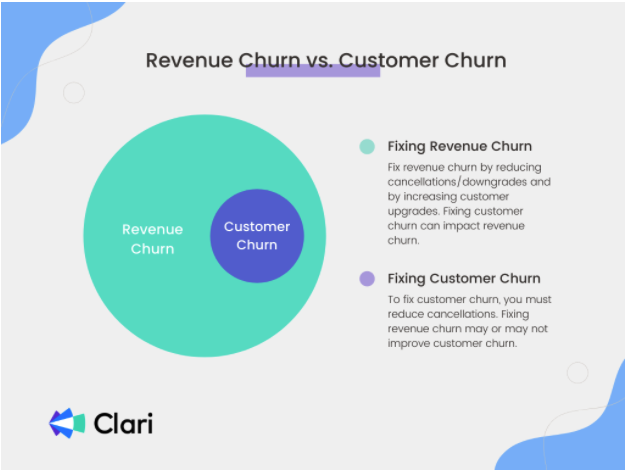

Comparing Customer Churn to Revenue Churn

As similar as they sound, customer churn and revenue churn give you different insights and serve different purposes. But fixing customer churn can help you fix revenue churn.

Here are a few distinctions to keep in mind:

Your revenue churn rate can be negative if new revenue exceeds lost revenue.

Your customer churn rate can’t be negative. Either you lose customers, or you keep them.

You must retain customers to fix high customer churn rates.

Revenue churn is more complex. Yes, if you have a high rate of customer churn, you’re more likely to have higher revenue churn, but customer churn may not be the only reason for the revenue churn fluctuation. If an existing customer spends less this month than last month, that’s also revenue churn. You’ve retained the customer but lost revenue.

When seeking to improve revenue churn, customer churn rate plays a role because it tells you the percentage of customers you’re losing to cancellations or failed charges. If you can identify why they’re leaving and fix those issues, you’ll improve both your customer churn rate and your revenue churn rate.

Improving Net Revenue Churn Rate

Once you understand why and where churn occurs in your organization, there are two ways to improve:

- Expand revenue

- Reduce customer churn

Expand your revenue

Any activity that expands your revenue can immediately improve your net revenue churn rate.

A good place to start is with current customers. They’ve already seen the value of your product. Obviously, they believe in it if they’ve bought into it.

Typical moves include:

- Upselling a customer on additional features or service support

- Selling additional licenses, for example, bringing marketing into a revenue operations platform, in addition to a sales team

- Negotiating a higher average selling price per license during renewals

- Extending the length of a contract to lock a company in as a customer and reduce overall churn

Which of those shifts make the most sense depends on the company, product, and customer needs, which is why there are entire teams devoted to customer success. But overall, the trend is clear: More revenue per renewal, coupled with a lower overall churn rate, means a lower revenue churn rate.

Reduce customer churn

Reducing customer churn is the second way to improve your revenue churn rate. The goal here is to improve adoption and usage, so customers are less likely to stop using your product.

You’ll need to focus on your customer success motion to achieve this goal. Customer success should treat clients as business partners, supporting them and helping them succeed. A low churn rate tells you that you’re aligning with customers and helping them achieve their goals.

Generally, these four strategies will improve customer retention:

- Improved customer support

- Better onboarding

- Improved user resources and education

- Better training for support and sales reps

But it starts with selling to well-qualified prospects. Encourage your sales reps to disqualify prospects who aren’t a good fit. Coach them to pursue deals that aren’t likely to churn.

Then, after closing the deal, apply the same rigor to renewal and expansion opportunities. Track the account health score, usage telemetry data, and other adoption indicators. Check-in with the customer to answer questions and make sure they have everything they need.

The Value of Knowing Your Revenue Churn Rate

To improve your revenue churn rate, you need loyal customers who continue to ascend your value ladder.

That’s why it’s essential to know your revenue churn rate. Business growth shouldn’t be a guessing game. You need to be able to quickly identify and improve issues that drive churn.

Uncover the reasons for poor churn rates, and you’ll find it easier to drive retention and growth.

Read more: