Tech stack bloat and the current negative macroeconomic environment will force sellers to do a better job managing their buyer committees in 2023. If your pipeline is getting smaller or you see deals taking longer, then you need to win what you have mid-funnel, and that path runs directly through your buyer committee.

But those people have their own challenges that you need to understand if you’re going to be successful in guiding them to their future state.

This post looks at the new pressures on buying committees and discusses three strategies for revenue teams to stop revenue leak springing from this extended group of decision makers. We’ll also take special note of the 2023 MVP of Buyer Committees—the CFO.

|

TL;DR To hear directly from actual CFOs on what they need to approve a deal, register for our Dec 8 CFO fireside chat. |

Buyer Committee Pressures in 2023

The smart money says we’re either in a recession or headed into one next year.

Even without the current macroeconomic climate, years of bloat have preceded a trend toward consolidation. Tropic says we’re overspending by up to 30%: too many tools, too much overlap, and too much money. Whatever the numbers, the fact is unless you’re one of your industry’s mission-critical platforms, it’s harder to sell than it was.

Then, macro put it under a microscope.

Every penny is under scrutiny from higher-ups in the buying org. The CFO signs off on everything, and it’s not uncommon to see the CEO weighing in. On top of that, there’s increased internal competition for budget.

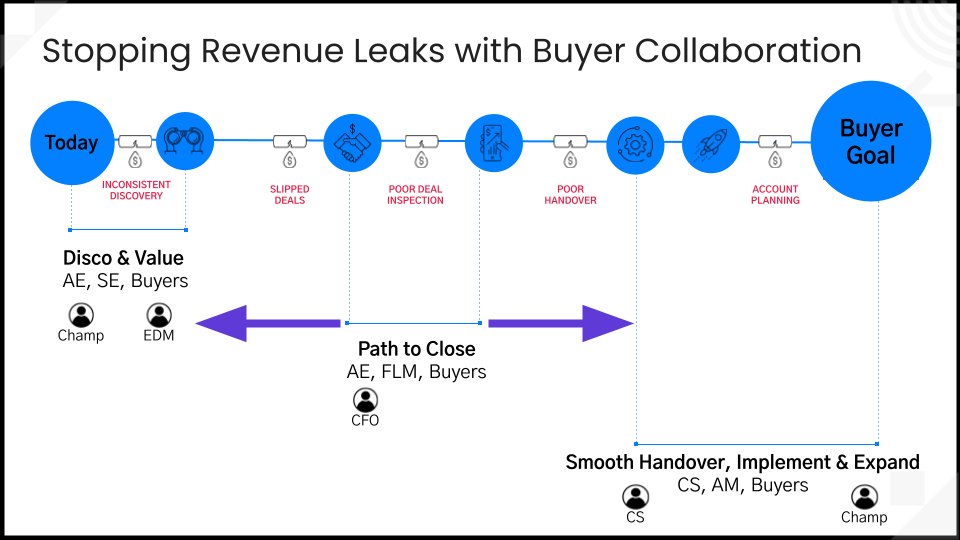

Larger buying committees, more executive scrutiny, and more internal competition for budgets are all sources of revenue leak that manifest across the buyer journey.

Sellers who recognize these revenue leak points can adjust tactics and thrive; those who don’t will just drown in preventable revenue loss from longer cycles, slipped deals, and decreasing win rates.

Facilitate cross-team collaboration

Multithreading has always been important, but with more people and more pressure, it’s the number one thing sellers can do to increase their chances of success.

As a seller, you wouldn’t want just one point of contact on the buyer team. Well, your buyers feel the same way.

“I was buying HR software recently. One reason I went with the vendor I selected was the rep’s honesty about his depth of knowledge. When we got deeper than he could go, he brought in the provider who’d actually be working on my account. It made a huge difference.”

Ethan McCarty, Integral, formerly Bloomberg, IBM

Develop bilateral relationships by bringing a Customer Success rep into pre-sale discussions. Have your IT teams talk. If one of their decision makers is their chief scientist, introduce your CTO. Encourage them to speak without the AE in the room, so they can talk peer-to-peer with the authenticity and openness that fosters trust and faster decision-making.

Lots of teams do this ad hoc. For predictable prevention of leak, make this cross-team collaboration part of your sales process. Include team rosters and expected roles in your mutual action plan to prompt sellers to ask the right questions at the right time.

|

💸CFO PRO: Train your CFO to be a good advocate. They don’t need to ask for the sale or run a 60-minute product demo, but they should be able to do some basic discovery, have one or two customer stories about how your org fixed similar pains, and be able to express value and ROI in CFO-friendly language. |

Serve everyone on the buying committee

Your champion wants to buy. They’re happy to take on any change management required. The other members of the buying committee likely don’t feel the same way: change brings risk and probably more work for them.

To get your proposal through the buying committee, you have to make a bullet-proof business case AND show a low-lift, low-risk implementation strategy.

Aim broad and high on your business case

It’s easy to make a business case for meeting your champion’s needs, but focusing on a single use case leaves you exposed. Suggest some other departments that will benefit from your solution and see if your champion can provide additional endorsements for your project.

You’ll have detractors in any large group. It’s not malicious. They probably just have their own priorities. To combat this, aim higher: show how your solution aligns with C-level strategic initiatives that no one would dare object to.

Be their guide on a low-risk path to their future state.

Whenever there’s an aversion to risk, you need to over-index on smooth implementation, minimal change management, and a fast time to value.

A traditional mutual action plan stops at close. By extending your plan through implementation, you’ll demonstrate how change management is baked into the plan. Use the post-close milestones to prove that every impacted team is already engaged and on board. Saving key call recordings is a great way to prove diligence here.

|

💸CFO PRO: CFOs think of themselves as the adult in the room, unswayed by the shiny object. In any CFO conversations or content, make sure you highlight how this purchase will impact IT and other operations teams close to the CFO and that you have their signoff. |

Polish makes a massive difference

The seller is rarely in the room when decisions are made. You need to rely on your champion to be your voice. Or rather, be their own voice.

Make sure that everything you give your champion is easy to share. If possible, give them PPTX or Google Slides instead of PDFs so they can incorporate your content into their internal decks. Use third-party sources, and make your content look more like something a consultant would share, with insights focusing on their problems, not your features.

Put all your reference material in a single collaboration workspace so it’s easy for the buying committee to find. Ideally your MAP automatically pushes engagement into your CRM or revenue platform to drive forecast confidence and prioritize who to talk with.

|

💸CFO PRO: There’s a strong possibility that your champion isn’t forwarding all your fantastic content to their CFO. This can be deadly. Chris Harper (SVP of Strategy and Innovation at Sales Impact Academy, former-Force Management) has a tactic to solve this. He says he only uses it for critical deals where he’s not sure the business case has been presented, and caveat emptor as there’s always a risk it could backfire: “Once I’m certain that the order is making its way up the chain, I email the CFO directly with the subject “Order form on your desk.” I say, ‘I know this is headed to you through the proper channels. I’m just doing my diligence and making sure you saw the business case along with the order form [one line summary of your business case/metrics]. I’m sure you’d want your sellers to do the same thing.’” Perhaps this is a place where your CFO can reach out to their CFO and redeem some of that credibility and trust they built up during pre-sale. |

TL;DR: Buyer collaboration delivers revenue precision

No amount of post-call coaching or analytics will win back a lost deal.

Teams that incorporate buyer collaboration into their revenue process will surface the right information in revenue-critical moments, so they can enjoy revenue precision even in the toughest macro environment.

- Multithread your deals by fostering cross-team collaboration.

- Make sure your business case has success metrics that matter to more than just your champion.

- Use a mutual action plan to guide your committee from discovery through implementation.

Be an honest broker of value.

You’ve got this!

Watch our CFO fireside chat to hear directly from actual CFOs on what they need to approve a deal.