It’s a very interesting time to be in sales. If you’re like the rest of us, the customers you’re selling to are reevaluating their spending, and lead scores look very different than they did a month ago.

None of us wanted to be here, but it’s the reality. As our customers pivot their strategy, sales and marketing must pivot together as well. And we have to go back to the basics of being brutally honest about the reality of our deals. It has to be done in order to forecast quarterly revenue accurately, which allows leadership to better plan for whatever the future holds.

The question my team is focused on answering: How can we help our sales and marketing teams thrive in this testing environment to retain and grow our customer base?

So, this is the ultimate exercise in pressure testing your deals, during a pressuring time.

After the acquisition of our largest competitor, we went from running a small sales team to a large one, with higher expectations and no room for forecasting errors. While this challenge is certainly the opposite to what we’re facing now, the solution is still the same: we need to live and breathe forecast accuracy to succeed.

That starts by defining a granular operating process to monitor deals progressively and make adjustments along the way. It also helps pull in cross-functional support where needed. So, first, you have to schedule your revenue cadence in a way that maximizes visibility.

Setting an Inspection Cadence

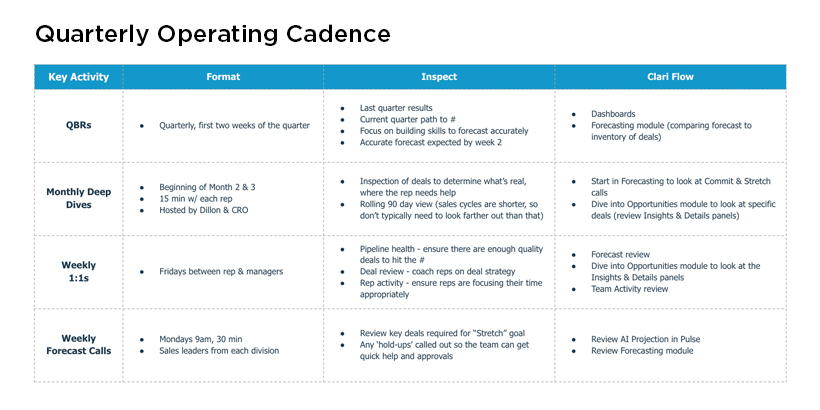

As you set your revenue cadence, you want to strike a balance between information intake and productivity. Only call the most necessary team members into a meeting. It’s a great way to ensure that everyone gets the most out of their time and won’t impede selling activities.

At Motus, we have four essential meetings for forecasting:

- Weekly Forecast Calls to identify any hold-ups that need help from other team members for all the leaders that manage quota carriers. Leaving the quota carriers to selling activities.

- Weekly 1:1s between the reps and managers to discuss pipeline health, and review each deal and rep productivity.

- Monthly Deep Dives with sales and leadership to look at all the deals in motion and determine how overall progress is going. Also known as a sales pipeline review.

- Quarterly Business Reviews to inspect last quarter results and focus on honing our forecast accuracy process. We expect a forecast by week two and continual updates for accuracy.

This cadence works exceptionally well for us, but you may choose more or less touchpoints based on your company’s business. However you do it, make sure to strike a balance and leverage the right tools so your reps can easily contribute to these meetings, but still have ample time to get in front of customers. As we’ve shifted to a virtual world, keeping this cadence has brought us all even closer together.

Maximizing Deal Inspection Accuracy

If you’re not leveraging accurate and real-time data to call your number, you’re wasting your time in all those meetings. When you think about your deal inspections, try using these three tips for accuracy:

Forecast Against Your Bank Account

Having a previous life in sales, I can relate to being overly confident in my forecast based on a ‘gut’ feeling deals that weren’t currently in the pipeline would come in. But gut checks are not a reliable way to roll up a forecast. This often results in reps committing more revenue than is reflected from the total value of their committed deals. To drive more informed decisions across your team, commit calls must be taken from their ‘commit bank account,’ which is the total revenue value of their committed deals. Similar to an actual bank account, reps can call their number up to, but no higher than, that amount. This helps coach newer reps from overzealous calls aka ‘happy ears’, and more tenured reps from sandbagging.

Identify the Real Deals

Your CRM alone isn’t going to help you much with accuracy. It wasn’t built for that. And sales reps tend to be allergic to the process of manually entering data. Can you blame them? They want to be selling! So, you should adopt some sort of AI on your CRM. Whether you buy a ready-made solution or build it yourself, you need to make sure that it captures the basics: when was the last meeting? When is the next meeting? Is communication bi-directional? Are we meeting with the same person every time? The answers to these questions all contribute to the accuracy of your lead scoring and therefore, your forecast.

Pressure Test the Forecast

Use AI projection to test the accuracy of your managers’ forecasts. Remember, some of them may be thinking like sales reps instead of taking a big-picture view, so this is a good tool to help coach them for their next stage. AI leads to more accurate forecasting by calling out sandbagging or overly optimistic projections, helping your team make the most logical decisions.

Yes, the current state of the economy has certainly added challenges onto the plates of sales leaders, but keep this in mind: our current situation will not last forever. And if we can stay aligned, and make decisions based on real-time data to help our customers, we’ll continue to build a path for future success, together.