For Fortune 500 revenue teams, the AI conversation has shifted.

It’s no longer “Should we adopt?” It’s “How do we get this operational and achieve maximum value?””

Every revenue team dreams of the exciting potential of AI agents delivering real-time insights and support. But behind the scenes, that vision hinges on something far less glamorous: clean, reliable data brought together across multiple systems and teams. It's not the kind of work that gets standing ovations in boardrooms, but it's the essential groundwork that makes those headline-worthy outcomes possible. As leaders, it's our responsibility to champion this foundational effort—even if it doesn’t feel executive-level exciting in the moment.

Leaders see the upside: increased win rates, shorter deal cycles, more accurate forecasts, and more sellers hitting quota. And companies that have fully adopted AI are making major strides. According to Clari’s State of Enterprise Revenue 2025 report, enterprises using AI are closing new logo deals 20% faster than they were two years ago.

But unlocking AI’s potential isn’t as simple as plugging in a new tool.

Enterprise teams are hitting roadblocks like messy data, fragmented workflows, and frontline resistance. To understand this friction, Clari Labs surveyed 400 CROs, VPs of Sales, and Revenue Operations leaders at enterprise organizations across North America with 1,000+ employees.

The findings are clear: the gap between AI ambition and reality is wider than most companies think.

Here are four reasons AI adoption is behind schedule.

Siloed Data is Limiting AI’s Impact

AI needs fuel to perform, and that fuel is data.

But in most enterprises, data is fragmented across various applications, spreadsheets, email threads, BI dashboards, and custom-built tools. Instead of one unified foundation, revenue teams are working with siloed snapshots. Even in the world’s largest enterprises, there is a lot of duct tape and manual processes holding things together.

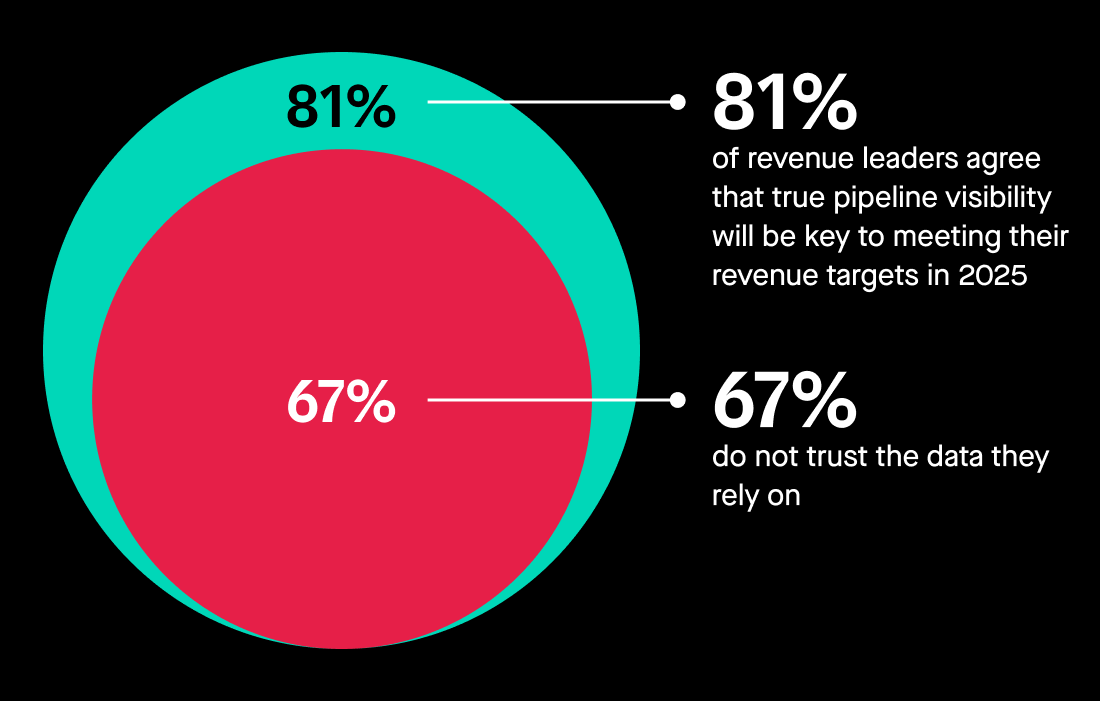

The most surprising finding from this report is that 67 of revenue leaders don’t trust their revenue data. What’s more, it’s estimated that businesses spent $13.8 Billion on AI last year alone. That’s a lot of money to be spending on something if you don’t inherently trust what’s feeding it.

Image source: AI Adoption in Running Enterprise Revenue

Without a firm foundation of data, AI models can’t deliver real-time execution, trustworthy predictions, or scalable workflows. Worse, when teams are forced to piece together inconsistent data, they start to question the AI’s output, eroding the trust needed for adoption.

You can’t scale AI until your revenue data is centralized, structured, and tied to the systems your team uses daily.

Revenue Teams Don’t Trust AI Output (Yet)

The #1 reason AI adoption has slowed? Frontline reps don’t trust the output.

According to the report, 17% of enterprise leaders cited lack of trust from sellers as the top barrier to AI adoption, edging out factors like executive support and lack of solution confidence.

This mistrust of AI has a ripple effect. When sellers don’t believe in AI-generated guidance, they won’t act on it. When managers don’t trust AI-driven scoring, they won’t use it to coach. And when leaders doubt the data behind AI forecasts, they revert to gut feel and spreadsheets.

The result? Broken workflows, inconsistent execution, and missed revenue targets.

One tool enterprise teams are using to build trust is an AI council.

These cross-functional groups bring together sales, IT, RevOps, and executive leadership to align AI initiatives with strategic goals, evaluate tools, and communicate expectations across the organization.

It’s a promising trend: with an estimated 55% of companies now having an AI council. That’s a major step forward from the early days of AI experimentation, when adoption was often fragmented and owned by isolated teams.

Still, there’s room for growth.

Many councils are in their infancy, and few have full representation from revenue leadership. Without clear ownership and communication, even the best AI tools will struggle to gain traction with frontline teams.

Building trust starts with alignment. AI councils can unify strategy, promote transparency, and give revenue teams the clarity they need to act with confidence.

Early Wins Are Tactical, Not Transformational

According to the report, the most common enterprise use cases for enterprise teams are:

- Prescriptive next steps on deals (35%)

- Predictive opportunity scoring (35%)

- Real-time call recommendations (34%)

- Outbound email generation (33%)

These are useful applications, to be sure. But they barely scratch the surface of what AI promised and what enterprise teams need to deliver consistent growth quarter after quarter.

Right now, AI is helping teams optimize individual tasks, not transform how they generate revenue. Sharper emails or next-step nudges don’t address systemic challenges like poor pipeline coverage, deal slippage, inaccurate forecasts, and missed targets.

For AI to earn trust and drive lasting change, enterprise teams need to see outsized, end-to-end impact. That means AI that:

- Surfaces risk before the deal is slips or is lost

- Aligns activity and investment across marketing, sales, and customer success

- Orchestrates handoffs, tasks, and follow-ups automatically

- Drives predictable, repeatable execution across the entire revenue process

Until that happens, many teams will continue to view AI as a nice-to-have add-on, not the revenue transformation engine it could be.

Executive takeaway: Don’t stop at the surface. AI’s biggest gains come when it’s embedded across the revenue lifecycle, not when it’s boxed into individual tools or teams.

AI Can’t Scale Without a Unified CRO–CIO

AI doesn’t belong to one department. It’s a cross-functional initiative that only works with shared ownership.

Critically, the CIO and CRO must work as partners.

The CRO brings the revenue strategy.

The CIO brings the data, infrastructure, and systems to support it.

But at many companies, these roles haven’t historically been aligned. Leaders still see their roles in silos with the CRO focused on hitting quota and the CIO focused on maintaining systems. This disconnect creates a real bottleneck.

Without a shared strategy, revenue leaders are left without the support they need to operationalize AI. CROs struggle to deploy tools that drive consistent execution across teams. And CIOs struggle to prove the business value of the tech investments they’ve made.

Instead of accelerating growth, AI gets stuck in pilot mode.

That’s why leading enterprise teams are closing the gap. They’re building shared AI roadmaps between revenue and IT. They’re co-owning success metrics. And they’re treating AI as a company-wide capability that supports revenue growth, efficiency, and strategic agility.

When the CRO and CIO move in lockstep, AI doesn’t just get rolled out.

It drives transformational change.

To scale AI, companies need strong executive alignment and a clear operating model. The fastest-moving companies are already investing in both.

What’s Really Holding AI Back?

The new report: AI Adoption in Running Enterprise Revenue reveals why AI adoption is falling short and what top-performing revenue teams are doing differently. By surveying 400 revenue leaders across enterprises, this report offers data-backed insights and benchmarks to help you move from AI ambition to execution.